Assistant Management Accountant

CPD Accredited | Free PDF & Hard Copy Certificate included | Free Retake Exam | Lifetime Access

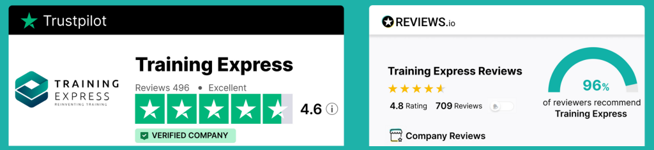

Training Express Ltd

Summary

- Digital certificate - Free

- Hard copy certificate - Free

- Exam(s) / assessment(s) is included in price

- Tutor is available to students

Add to basket or enquire

Overview

If you’ve ever considered working as a Assistant Management Accountant but felt like you lack the knowledge and skills to launch your career, this course might be what you want! The Assistant Management Accountant course will allow you to equip yourself with a solid foundation and develop more advanced skills on that foundation. Enrol today to learn all the required knowledge and skills to pursue a rewarding career in the relative industry.

The Assistant Management Accountant course is for both beginners and those already working in the field. It covers gradually from basics to advanced concepts of being a successful Assistant Management Accountant. Anyone passionate about learning can take this course and develop skills and a portfolio to have a competitive edge in the job market. Also, upon completing our Assistant Management Accountant course, you will get a widely respected accreditation and a deeper knowledge of the topic.

Key Benefits

- Accredited by CPD

- Instant e-certificate

- Fully online, interactive course

- Self-paced learning and laptop, tablet, smartphone-friendly

- 24/7 Learning Assistance

CPD

Course media

Resources

- Training Express Brochure - download

Description

Curriculum

- Module 01: Introduction to Accounting

- Module 02: The Role of an Accountant

- Module 03: Accounting Concepts and Standards

- Module 04: Double-Entry Bookkeeping

- Module 05: Balance Sheet

- Module 06: Income statement

- Module 07: Financial statements

- Module 08: Cash Flow Statements

- Module 09: Understanding Profit and Loss Statement

- Module 10: Financial Budgeting and Planning

- Module 11: Auditing

- Module 12: Introduction to Financial Management

- Module 13: Statement of Stockholders’ Equity

- Module 14: Analysing and Interpreting Financial Statements

- Module 15: Inter-Relationship Between all the Financial Statements

- Module 16: International Aspects of Financial Management

- Module 17: Introduction to Debt Management

- Module 18: Long Term and Short Term Debt

- Module 19: Identifying Your Debt

- Module 20: Debt Management Plan

- Module 21: Debt Assessment

- Module 22: Debt Financing

- Module 23: Building Budget

- Module 24: Debt Counselling

- Module 25: When Is Debt Good?

- Module 26: Avoiding Debt Problems

- Module 27: How to Handle Debt Collectors

- Module 28: How to Get Out of Debt

- Module 29: Dealing with Bankruptcy and Insolvency

- Module 30: Laws and Regulations

Learning Outcomes:

- Understand fundamental accounting principles and standards effectively.

- Apply double-entry bookkeeping techniques accurately in financial transactions.

- Analyze and interpret financial statements proficiently for decision-making.

- Develop comprehensive financial budgets and plans efficiently.

- Demonstrate knowledge of debt management strategies competently.

- Comply with laws and regulations governing financial management adeptly.

Course Assessment

You will immediately be given access to a specifically crafted MCQ test upon completing an online module. For each test, the pass mark will be set to 60%.

Certificate

Once you’ve successfully completed your course, you will immediately be sent a digital certificate. Also, you can have your printed certificate delivered by post (shipping cost £3.99). Our certifications have no expiry dates, although we do recommend that you renew them every 12 months.

Who is this course for?

- Individuals seeking foundational knowledge in accounting principles.

- Aspiring assistant management accountants aiming for career advancement.

- Professionals desiring to enhance their financial management skills.

- Those interested in understanding debt management strategies.

- Students preparing for roles in auditing or financial analysis.

Requirements

There are no formal entry requirements for the course, with enrollment open to anyone!

Career path

- Assistant Management Accountant - £25K to £35K/year.

- Financial Analyst - £30K to £45K/year.

- Auditor - £28K to £40K/year.

- Budget Analyst - £25K to £35K/year.

- Debt Counsellor - £20K to £30K/year.

Questions and answers

Currently there are no Q&As for this course. Be the first to ask a question.

Certificates

Digital certificate

Digital certificate - Included

Once you’ve successfully completed your course, you will immediately be sent a FREE digital certificate.

Hard copy certificate

Hard copy certificate - Included

Also, you can have your FREE printed certificate delivered by post (shipping cost £3.99 in the UK).

For all international addresses outside of the United Kingdom, the delivery fee for a hardcopy certificate will be only £10.

Our certifications have no expiry dates, although we do recommend that you renew them every 12 months.

Reviews

Currently there are no reviews for this course. Be the first to leave a review.

Legal information

This course is advertised on reed.co.uk by the Course Provider, whose terms and conditions apply. Purchases are made directly from the Course Provider, and as such, content and materials are supplied by the Course Provider directly. Reed is acting as agent and not reseller in relation to this course. Reed's only responsibility is to facilitate your payment for the course. It is your responsibility to review and agree to the Course Provider's terms and conditions and satisfy yourself as to the suitability of the course you intend to purchase. Reed will not have any responsibility for the content of the course and/or associated materials.